How Much EMI for 30 Lakh Home Loan for 20 Years? | Salary-Wise Home Loan Eligibility Explained

Introduction

Buying a home is a major financial milestone. The most common questions are about EMIs, salary eligibility, and how much loan a person can actually get with a specific monthly income. This blog addresses all major home loan queries: exact EMI calculations for ₹30 lakh loans, official eligibility rules at top banks, income-wise loan estimations, and proven tips to get higher loan approvals. By the end, readers will confidently know their EMI affordability and salary-to-loan eligibility in every Indian scenario.

EMI for 30 Lakh Home Loan

EMI Calculation Formula

EMI is calculated using:

EMI=P×R×(1+R)N(1+R)N−1EMI = \frac{P \times R \times (1+R)^{N}}{(1 + R)^{N} – 1}EMI=(1+R)N−1P×R×(1+R)N

Where PPP is the principal, RRR is the monthly interest rate (annual rate12×100\frac{\text{annual rate}}{12 \times 100}12×100annual rate), and NNN is the loan tenure in months.

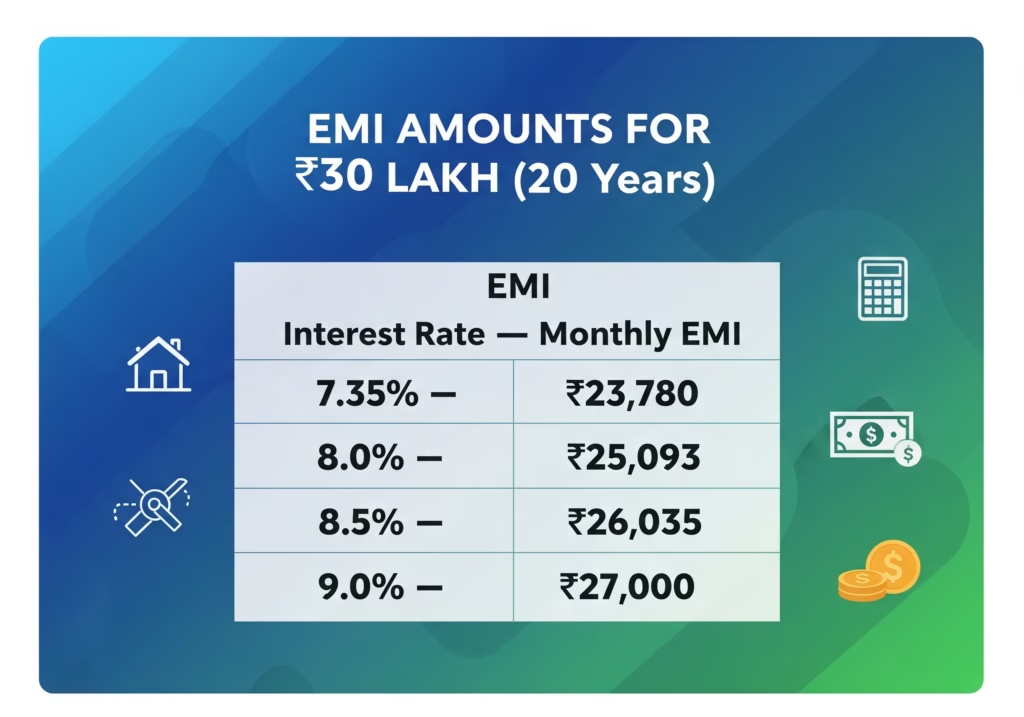

EMI Amounts for ₹30 Lakh (20 Years)

Below are round numbers for modern interest rates, verified by leading home loan calculators:4

| Interest Rate | EMI (₹) | Total Interest (₹) | Total Payment (₹) |

| 8.0% | 25,093 | 30,22,255 | 60,22,255 |

| 8.5% | 25,935 | 31,24,444 | 61,24,444 |

| 9.0% | 26,996 | 32,79,031 | 62,79,031 |

| 9.5% | 28,298 | 34,66,634 | 64,66,634 |

Banks like HDFC, SBI, Axis, ICICI, IDFC FIRST, and Bajaj Finserv offer online home loan EMI calculators; every EMI can be instantly calculated with exact tenure and rate.

Bank-Specific Example: HDFC

- HDFC offers EMIs starting around ₹25,935 for ₹30 lakh at 8.5% for 20 years.

- For 15 years tenure, EMI rises to ~₹30,500. For 25 years, EMI drops to ~₹24,000 but total interest paid increases.

- HDFC lets borrowers prepay any amount or transfer balances to lower rates for maximum flexibility.

Salary & Home Loan Eligibility: All Scenarios

How Much Loan for Various Salaries?

India’s top lenders generally allow 40–55% of net income for max EMI. Loan amounts for different salaries and 20-year tenure are estimated below, using official calculators:

| Net Monthly Salary (₹) | Max EMI (₹) | Loan Eligible (₹) |

| 20,000 | 9,000 | 10–12 lakh |

| 30,000 | 13,000 | 15–18 lakh |

| 40,000 | 18,000 | 22–25 lakh |

| 50,000 | 23,000 | 28–32 lakh |

| 60,000 | 27,000 | 35–38 lakh |

| 70,000 | 32,000 | 40–44 lakh |

Banks consider your age, tenure, city, existing debts, and credit score. Adding a co-applicant (like spouse) boosts eligibility by combining incomes—making joint home loans a powerful tool for higher loan amounts.

Case Studies (Real Scenarios)

- A: Salaried, ₹40,000 p.m., no other debts

- Likely eligible: ₹22–25 lakh loan for 20 years. EMI cap: ₹18,000–20,000/month.

- B: Salaried, ₹30,000 p.m., active car loan EMI ₹5,000

- Net EMI capacity: ₹10,000–12,000. Likely loan: ₹13–15 lakh.

- C: Self-employed, average annual profit ₹4,00,000

- Net monthly profit: ₹33,000. Likely eligible: ₹14–16 lakh, subject to ITR proof and credit review.

- D: Joint applicants (combined salary ₹80,000)

- Max EMI: ~₹38,000–40,000/month; Loan eligibility: up to ₹50 lakh.

Salary vs Loan Table (Bajaj Finserv, 2025)

| Net monthly salary | Eligible loan amount (₹) |

| 25,000 | 15,07,211 |

| 30,000 | 18,08,653 |

| 35,000 | 21,10,096 |

| 45,000 | 27,12,980 |

| 50,000 | 30,14,422 |

| 60,000 | 36,17,307 |

| 1,00,000 | 64,59,477 |

(Source: Bajaj Finserv Home Loan Eligibility Calculator, 2025).

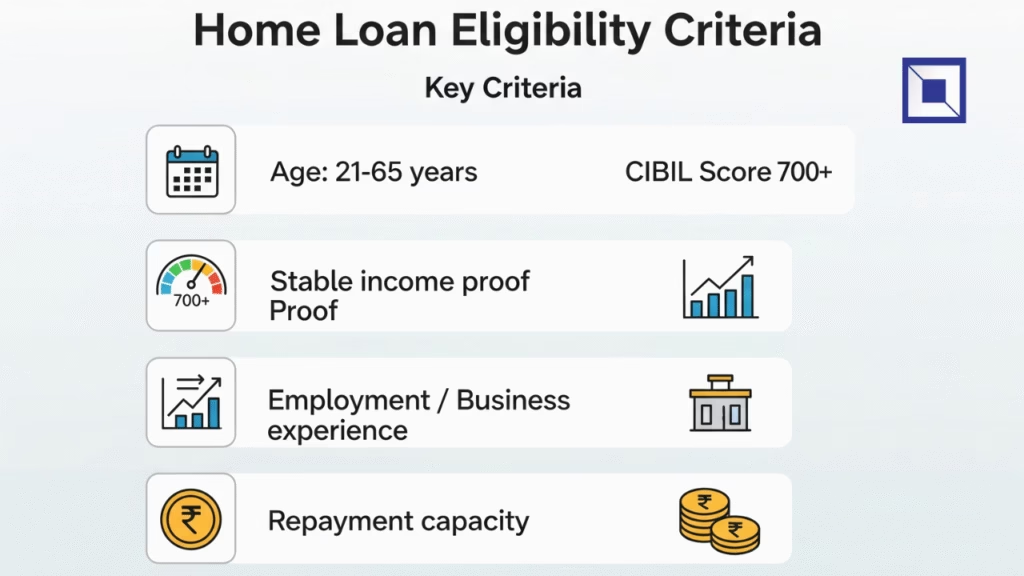

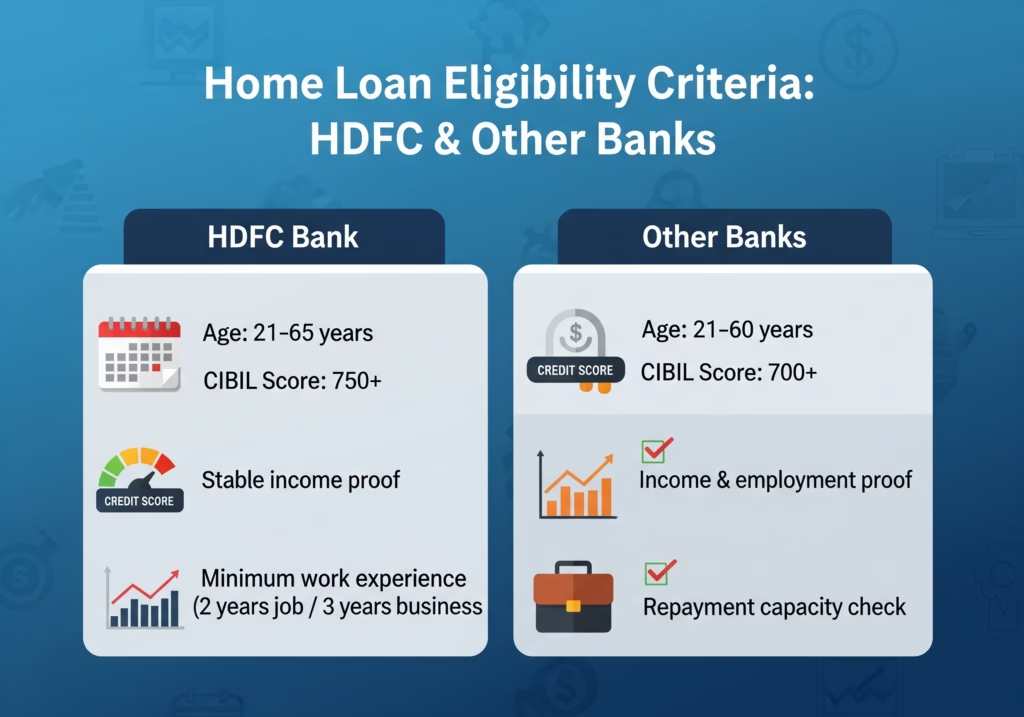

Home Loan Eligibility Criteria: HDFC & Other Banks

HDFC Eligibility (2025)

- Nationality: Indian Residents, NRIs.

- Employment: Salaried (21–65 years)/Self Employed (21–70 years).

- Minimum salary: ₹10,000/month (HDFC), ₹25,000 (Bajaj Finserv), varies by city and property.

- Cibil Score: Minimum 650, but 750+ preferred for lower rates.

- Loan-to-Value (LTV): Up to 90% for properties under ₹30 lakh, 80% for ₹30–75 lakh, 75% above ₹75 lakh.

- Maximum EMI/Income: ~50%.

Banks check qualification, job stability, spouse’s income, dependents, prior loan history, and credit card usage. Self-employed need proof of business income, ITRs for past 2–3 years, and business registration documentation.

Minimum Income and Smart Loan Tips

Minimum Salary for Home Loan

- HDFC: ₹10,000/month minimum.

- Bajaj Finserv: ₹25,000/month minimum for most urban areas.

- Axis, SBI, ICICI: ₹15,000–20,000/month typical.

For larger metros, banks may require ₹25,000–30,000 base income for properties above ₹30 lakh. For smaller towns, lower income may suffice for small principal loans.

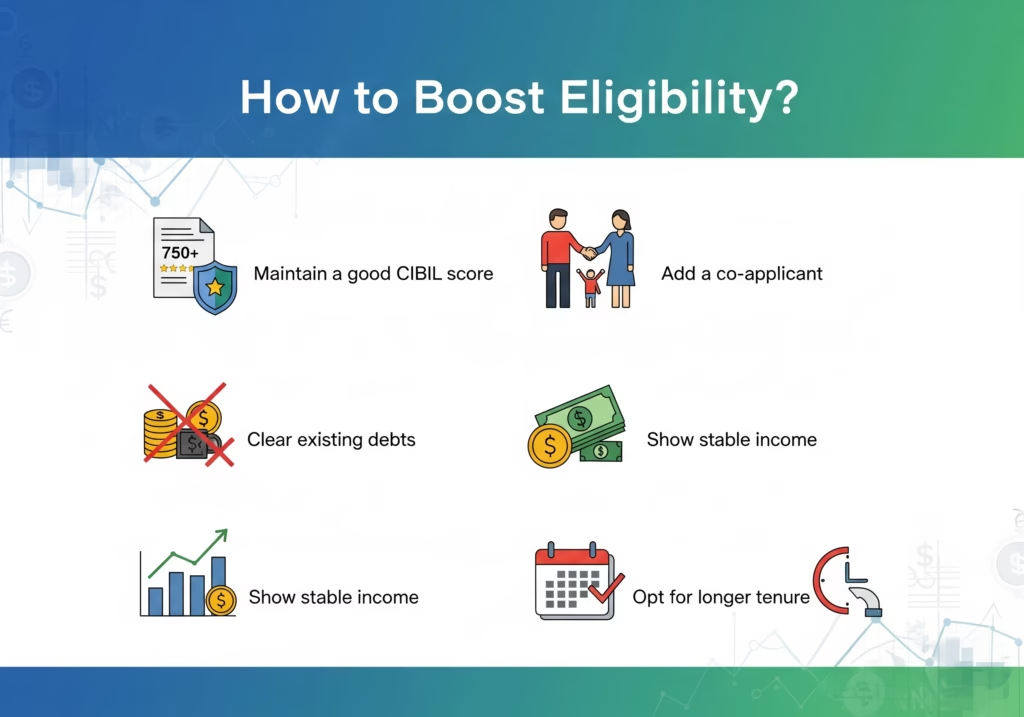

How to Boost Eligibility?

- Add co-applicant (spouse/parent)

- Reduce existing EMIs before applying

- Show stable employment & rising income

- Maintain credit score above 750

- Opt for longer tenure (lower EMI)

- Provide clear financial documentation

Conclusion

A ₹30 lakh home loan for 20 years will typically cost an EMI of ₹25,000–27,000 per month, and the eligibility depends on a combination of salary, tenure, other debts, and credit score. Minimum income required ranges from ₹10,000–25,000 per month, but realistic loan approval for a ₹30 lakh loan usually requires a salary of ₹50,000+ unless combined with a co-applicant.

For best chances, maintain a good credit score and use online calculators like HDFC and Bajaj Finserv to check your eligibility instantly. For personalized results and accurate advice, MyLoanKart’s home loan calculator can help find the perfect EMI and salary combination for every budget.

FAQ’s

What is a home loan?

A home loan is a secured loan provided by banks and financial institutions to purchase, build, or renovate a residential property. It is repaid in equated monthly installments (EMIs) over a specified tenure.

Who is eligible to apply for a home loan?

Eligible applicants are Indian residents or NRIs aged between 21 and 65 years, with a regular income source (salaried/self-employed), a good credit score, and proof of income. Minimum age and income criteria vary by lender.

How do I check my home loan eligibility?

Loan eligibility depends on your age, income, credit score, existing debts, and the property value. Most banks provide online eligibility calculators to estimate the loan amount you can avail based on your profile.

What documents are required for a home loan application?

Common documents include identity and address proof (Aadhaar, PAN, Passport), income proof (salary slips, IT returns), bank statements, property documents (sale deed, agreement), and passport-sized photographs.

What is the home loan approval process?

The process involves eligibility check, document submission, verification, credit appraisal, sanctioning the loan with terms approval, and finally disbursal of loan to the property seller.

How is the EMI on a home loan calculated?

EMI depends on loan amount, interest rate, and loan tenure. The formula distributes repayments equally over the tenure covering both principal and interest. Most banks offer online EMI calculators for convenience.

What are the current interest rates for home loans in India?

Home loan interest rates generally range from 7% to 9% as of 2025, depending on the lender, customer profile, and market conditions. Rates may be fixed or floating.

Can I get a home loan with a low credit score?

Lenders prefer credit scores above 700 for hassle-free approval. Scores between 650–700 may still get approved but with higher interest rates or additional documentation.

What is the maximum tenure for a home loan?

Most lenders offer home loan tenures up to 30 years, allowing borrowers to choose EMIs that fit their financial plans.

Are there tax benefits on home loans?

Yes, under Indian tax laws, you can claim deductions on the principal repayment under Section 80C (up to ₹1.5 lakh) and interest paid under Section 24(b) (up to ₹2 lakh) while filing income tax returns.

Can I apply for a home loan online?

Yes, most banks and NBFCs provide online application facilities for convenience, faster processing, and easier document uploads.

What happens if I prepay or foreclose my home loan?

Prepayment may attract nominal charges depending on lender policies, but recent RBI guidelines have reduced or waived these charges for floating-rate loans.