UCO Bank Home Loan Interest Rate: Everything You Need to Know

When it comes to purchasing your dream home, one of the most crucial factors to consider is the UCO Bank home loan interest rate. As one of the leading public sector banks in India, UCO Bank offers attractive home loan schemes with competitive home loan interest rates. In this blog, we will explore the current UCO Bank home loan interest rates, the types of loans available, eligibility criteria, and how to apply for a home loan with UCO Bank.

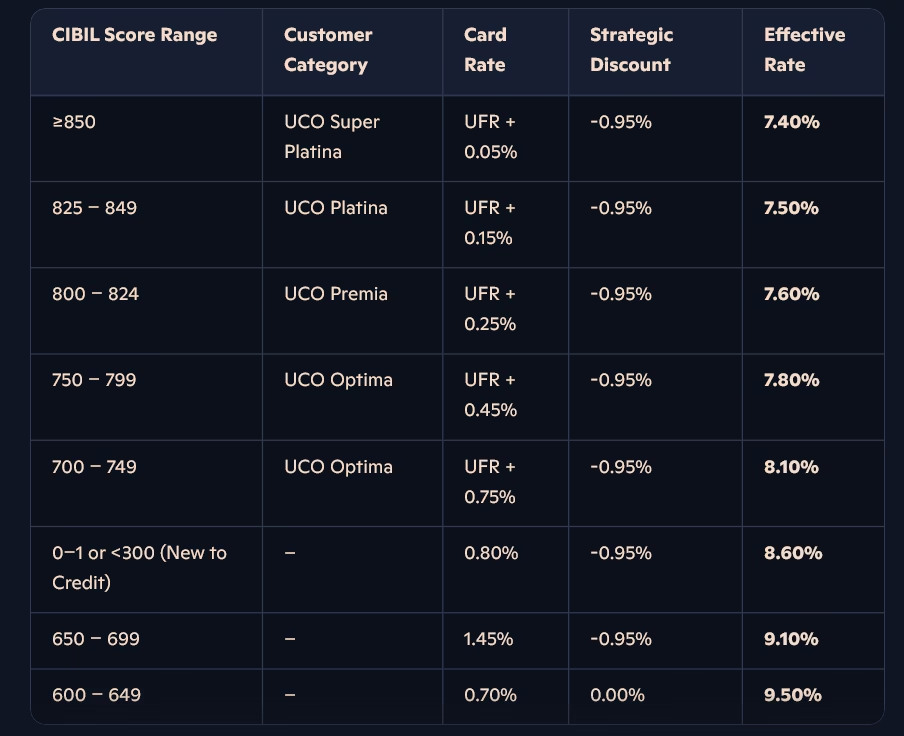

Current UCO Bank Home Loan Interest Rates

As of the latest updates, UCO Bank home loan interest rates range from 8.35% to 8.70% per annum. These rates are competitive compared to other banks, making UCO Bank home loan interest rates a popular choice for many homebuyers.

- For Loans Up to ₹30 Lakh: 7.40% p.a.

- For Loans Above ₹30 Lakh: 9.50% p.a.

These UCO Bank home loan interest rates are dynamic and may change based on market conditions and the applicant’s profile, such as credit score, loan amount, and tenure.

Processing Fees

- Processing Fees: UCO Bank typically charges a processing fee of around 0.5% of the loan amount, minimum 1500 and maximum 15000 +gst (Waived till 30.06.2024), which can vary depending on the home loan scheme.

Types of Home Loans Offered by UCO Bank

UCO Bank offers several home loan products designed to meet the needs of various customers. Whether you’re purchasing a new property, renovating your current home, or refinancing an existing loan, UCO Bank has a product for you.

1.Home Loan

This is the standard loan offered by UCO Bank for purchasing a new home or apartment. The loan term can go up to 30 years with flexible EMI options, making it a great choice for homebuyers. The UCO Bank home loan interest rate for this product starts at 8.35% per annum.

2.Home Improvement Loan

If you’re looking to renovate or repair your existing home, UCO Bank offers a home improvement loan at attractive UCO Bank home loan interest rates.

3.Home Extension Loan

If you want to extend your home, such as adding a room or an extra floor, UCO Bank offers a loan to fund home extensions at the best possible UCO Bank home loan interest rates.

4.Balance Transfer Facility

UCO Bank offers a home loan balance transfer option, where you can transfer your existing home loan from another lender to UCO Bank at lower UCO Bank home loan interest rates. This can help reduce the total interest burden on your home loan.

5.NRI Home Loans

UCO Bank provides special home loans for Non-Resident Indians (NRIs) at the same UCO Bank home loan interest rates, enabling NRIs to purchase property in India.

Eligibility Criteria for UCO Bank Home Loans

Before applying for a home loan with UCO Bank, it is important to understand the eligibility criteria, which ensure that only eligible applicants are granted loans at favorable UCO Bank home loan interest rates.

1.Age

- The applicant should be between 21 to 60 years of age at the time of loan maturity.

2.Income

- Applicants must have a stable income to ensure they can repay the loan. UCO Bank will assess the applicant’s monthly income to determine eligibility for the loan at the desired UCO Bank home loan interest rates.

3.Employment Status

Both salaried and self-employed individuals can apply for a home loan at UCO Bank. Salaried applicants are required to provide salary slips, whereas self-employed individuals must submit business-related documents.

4.Credit Score

- A CIBIL score of 750 or above is preferred for better interest rates, ensuring that applicants qualify for the best UCO Bank home loan interest rates.

5.Property Ownership

- The property being purchased must be in the applicant’s name or jointly with a co-applicant. UCO Bank also accepts properties with clear titles.

6.Co-Applicant

- A co-applicant can be included in the home loan application to improve eligibility and increase the loan amount at favorable UCO Bank home loan interest rates.

Quantum of Loan

The maximum loan limits for construction or purchase vary by location, as detailed below.

| Location/Centre | For Construction/ Purchase/ Takeover/Extension | For Repair/ Renovation |

| Metro/Urban/Semi-urban/Rural | No upper limit | Rs.50 lac |

Loan Entitlement

The eligible loan amount will be the lower of the two calculations mentioned below:

Important Considerations

- Stamp Duty, Registration & Documentation Charges

These costs are excluded from the housing property’s value when calculating the Loan-to-Value (LTV) ratio.

However, for housing units costing ₹10.00 lakhs or less, these charges may be included in the project cost to determine the LTV. - Insurance Premium

The premium for insuring the mortgaged property and/or the borrower’s life (for the loan tenure) can be included as part of the project cost. - Repair / Renovation / Extension

The loan amount for such cases will be as per scheme limits and must not exceed the stipulated percentage of the estimated cost.

Loan Eligibility Criteria

1. Based on Property Cost (LTV Ratio)

- Up to ₹30 lakhs → Loan up to 90% of property/project cost

- Above ₹30 lakhs to ₹75 lakhs → Loan up to 80% of project cost

- Above ₹75 lakhs → Loan up to 75% of project cost

2. Based on Gross Monthly Income (GMI) vs EMI

For Indian Residents, total deductions (existing + proposed EMI) should not exceed the limits below:

- GMI up to ₹50,000 → Maximum EMI: 60% of GMI

- GMI ₹50,001 to ₹1,00,000 → Maximum EMI: 70% of GMI

- Minimum take-home pay after deductions: ₹20,000

- GMI above ₹1,00,000 → Maximum EMI: 75% of GMI

- Minimum take-home pay after deductions: ₹30,000

For NRI & PIO:

| Income Slab | Total deductions permissible including proposed EMI |

| GMI up to Rs.1,50,000/- | 50% of GMI |

| GMI above Rs. 1,50,000/- | 60% of GMI |

How to Apply for a UCO Bank Home Loan

Applying for a home loan with UCO Bank is simple and can be done both online and offline. Here’s a step-by-step guide:

1. Online Application

- Visit the official UCO Bank website and go to the Home Loan Section.

- Fill in the application form by providing your personal and financial details.

- Upload the necessary documents, including identity proof, income proof, and property documents.

- After submission, UCO Bank will review your application and let you know the status.

2. Offline Application

- Please visit the nearest UCO Bank branch to obtain the home loan application form.

- Fill out the form and submit it with the necessary documents.

- UCO Bank’s representatives will assist you in completing the process.

3. Loan Processing

- Once your application is submitted, UCO Bank will verify your documents, conduct a property valuation, and assess your eligibility for the home loan at the best UCO Bank home loan interest rates.

4. Loan Disbursement

- After approval, you will receive the loan sanction letter, and the loan amount will be credited to your account. You can now proceed with purchasing your property.

Factors to Consider Before Applying for a UCO Bank Home Loan

Before deciding to apply for a home loan, consider these factors to ensure you’re getting the best deal with UCO Bank home loan interest rates:

1.Interest Rates

- While UCO Bank home loan interest rates are competitive, always compare them with other banks to ensure you’re getting the best rate.

2.Loan Tenure

- UCO Bank offers flexible loan tenures of up to 30 years, but ensure you select the right tenure based on your financial situation.

3.Processing Fees

- Be aware of the processing fees and any additional charges associated with the loan, as these can increase the total cost of your loan.

4.Prepayment Charges

- Check for any prepayment penalties with UCO Bank. Some banks charge for early loan repayment, while others allow it without any fees.

5.Loan Repayment Capacity

- Assess your income and financial obligations to ensure you can comfortably manage the EMI payments. Choosing a loan with a larger amount than necessary can lead to repayment stress.

6.Rate of Interest

Enjoy an additional concession of 0.10% on takeover loans and 0.05% for women borrowers when the property is owned by a female.

Special Concessions

- Takeover Loans: Additional interest concession of 0.10%

- Women Borrowers: Additional interest concession of 0.05%, applicable when the property is owned by a female

Conclusion

UCO Bank home loan interest rates are among the best in the market, offering a range of exclusive loan products tailored to meet the needs of diverse customers. Whether you’re purchasing a new home, refinancing an existing loan, or making improvements to your current property, UCO Bank delivers transformative solutions with attractive interest rates and flexible repayment options.

Before applying, always compare the interest rates, processing fees, and other charges to ensure that UCO Bank is the right choice for your home financing needs. By doing so, you can make an informed decision and take a step closer to owning your dream home. .