Home Loan

- Eligibility & Quotes from top PSU & Pvt. Banks

- Lowest Interest Rates

ROI starts @ 7.40%, Processing Charges Rs. 5000/- Max

ROI Starts@7.35% ,Processing Charges 0.35% (Rs.36,000/- Max)

ROI Starts at @7.50%., PF Rs. 8500/-(Min) Rs. 25000/-(Max)

ROI Starts @ 7.50, PF 0.35% (Rs. 10,000/- Max)

ROI Starts 7.45% Processing Fees 0.35% (Rs 15,000/- Max)

ROI Starts @7.35%, PF 0.35% (Rs 30,000/- Max)

Banks and financial institutions provide home loans to help individuals purchase property. These loans can also be used for construction, renovation, or expansion of a home, with repayment spread over a selected period. Since home loans are secured against the property, failure to repay may result in the lender reclaiming and selling the property to recover the outstanding dues.

Eligibility for a home loan is determined by various factors, including an applicant’s income, credit history, property value, and location. These criteria influence the maximum loan amount that can be approved.

Top Banks Offering Lowest Home Loan Interest Rates 2025

Explore the leading banks in India offering the lowest home loan interest rates. Compare their offerings and conveniently apply online to secure the best home loan for your needs.Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Interest Rates 8.00% – 10.35%

Processing Fees

- 0.25% of the loan amount, subject to a minimum and maximum of INR 1,500 and INR 20,000, respectively

Interest Rates 8.00% – 9.60%

Processing Fees

- Upto 0.50% of the loan amount or Max INR 7,500 + GST

Interest Rates 13.00% – 20.00%

Processing Fees

- 2%-3% of the loan amount (Including GST)

Processing Fees

- Up to 1.00% of the Loan amount subject to minimum of INR 10,000 + GST

Interest Rates 8.00% – 10.80%

Processing Fees

- 0.35% of the loan amount + GST

- Minimum 2000 + GST

- Maximum of 10000 + GST Advocate & Valuer fee – actual expenses will be realised separately.

How to Apply for a Home Loan Online?

MyLoankart Experts simplify the home loan selection process by guiding you to the best options based on your eligibility. Their approach is far more convenient than visiting multiple lenders in person.

Steps to Apply for a Home Loan:

- Fill out the form at the top of the page, providing:

- Desired loan amount

- Employment status and monthly income

- Full name, city, date of birth, contact number, and email ID

- Accept terms and conditions

- Click on “Get Quotes”

- After submission, another form will appear where you need to enter:

- Property details (value, applicant’s gender, residence address, PAN number)

- Click “Get Quotes” again

- You’ll then receive a list of banks where you qualify for a home loan.

WhatsApp Home Loan Application:

MyLoanKart has collaborated with WhatsApp, allowing users to apply for a home loan seamlessly—just like chatting with a friend. Answer a few simple questions, and the chatbot will generate a list of loan options, making the process smooth and hassle-free.

Features & Benefits:

- Interest rate starting from 8.65% per annum

- Exclusive rates for women borrowers

- Fixed EMI throughout the loan tenure

- Interest subsidy available via PMAY CLSS scheme

- Tax benefits up to ₹1.5 lakh on principal & ₹2 lakh on interest

- Option for top-up loans for renovation, extension, or reconstruction

- Home loan balance transfer facility

- Tenure up to 30 years

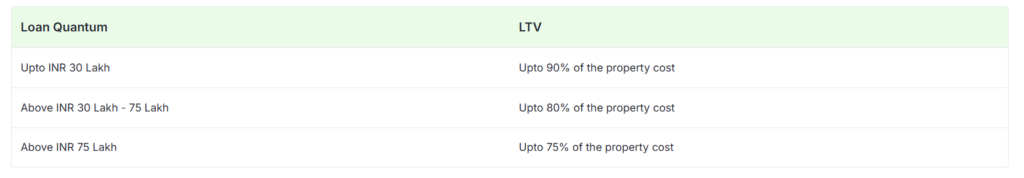

- Loan amount depends on LTV ratio and outstanding balance

- Processing fee starting from 0.35% + GST

- Substitute income documents available (ITR or annual turnover)

- Co-borrowers can avail tax benefits if they are property co-owners

Types of Home Loans:

Banks & NBFCs offer various loan options, including:

- Home Purchase Loan

- Land Purchase/Plot Loan

- Home Construction Loan

- Home Improvement Loan

- Home Conversion Loan

- Home Extension Loan

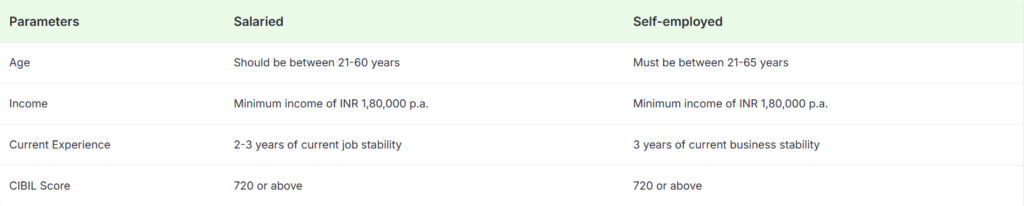

What is the eligibility criteria for Home Loans?

Home loan eligibility is based on income, age, credit score, property value and location, etc. The table shows general eligibility criteria at all banks/NBFCs.

Home Loan Eligibility and Maximum Loan Amount Calculation

Checking your home loan eligibility helps you determine the maximum loan amount you qualify for, making it easier to plan your purchase. Lenders assess key factors such as income, CIBIL score, age, professional stability, and property location to determine eligibility. A CIBIL score of 720 or above is typically required for properties in authorized locations. However, if your score is below 720 due to genuine reasons, some NBFCs may still approve your loan but at a higher interest rate.

How Much Loan Amount Can You Get Based on Your Salary?

Lenders calculate home loan eligibility primarily based on your net take-home salary:

- Only 50% of your monthly income is considered for loan eligibility.

- Existing EMIs on other loans impact the final loan amount.

- If you are already paying an EMI, it is deducted from the 50% of your salary to determine the disposable amount available for home loan EMIs.

Understanding Fixed Obligations to Income Ratio (FOIR)

Lenders use FOIR to evaluate home loan eligibility by factoring in existing EMIs and net income. The FOIR percentage should ideally be 75% or less.

Example:

- Net monthly salary: ₹1,00,000

- Existing EMIs:

- Car loan EMI: ₹6,000

- Personal loan EMI: ₹10,000

Calculation:

- Disposable income for a new loan = ₹50,000 – ₹6,000 – ₹10,000 = ₹34,000

- FOIR formula = (Sum of existing obligations / Net take-home salary) × 100

= (₹6,000 + ₹10,000) / ₹1,00,000 × 100

= ₹16,000 / ₹1,00,000 × 100

= 16% FOIR

Based on this FOIR, lenders will approve a home loan amount with EMIs of ₹34,000 or less for the longest tenure.

Additionally, maintaining a high credit score improves your chances of securing a better interest rate from lenders.

Loan to Value Ratio

A home loan does not cover the full cost of the property, so borrowers should understand the loan amount they can secure for their purchase. Most lenders, particularly banks, determine this amount based on the Loan-to-Value (LTV) ratio, as outlined below.

Home Loan EMI Calculator: Why Should You Check It?

Before applying for a home loan, it’s helpful to use an EMI calculator to estimate your monthly installment amount. The calculator considers three factors:

- Loan amount

- Interest rate

- Tenure

Simply enter these details in an online EMI calculator, and it will instantly display your expected monthly EMI and the total interest payable over the loan tenure.

Required Documents for a Home Loan Application

The documentation process varies for salaried and self-employed applicants. Below is a list of documents needed:

📌 For Salaried Applicants:

- Completed home loan application form

- Identity proof (Aadhaar Card, Passport, PAN Card, Voter ID, or Driving License)

- Address proof (Passport, Aadhaar Card, Utility Bill)

- Residence ownership proof (Property documents, Maintenance Bill, Electricity Bill)

- Income proof (Last 3 months’ salary slips & Form 16)

- Job continuity proof (Employment certificate or appointment letter if employed for over 2 years)

- Bank statements (Latest 1-year statement where salary is credited)

- Property documents (Sale Deed, Share Certificate, Latest Maintenance Bill, Sanction Letter if applicable)

- Advance processing cheque

- Investment proof (Fixed Deposits, Shares, Fixed Assets)

- Passport-size photographs

📌 For Self-Employed Applicants (Professionals & Non-Professionals):

- Completed home loan application form

- Identity proof (Aadhaar Card, Passport, PAN Card, Voter ID, or Driving License)

- Address proof (Passport, Aadhaar Card, Utility Bill)

- Residence ownership proof (Property documents, Maintenance Bill, Electricity Bill)

- Income proof (Latest 3 years’ Income Tax Returns, Profit & Loss Account, Balance Sheet, Audit Report)

- Business existence proof (Shop Establishment Act, Tax Registration Copy, Company Registration License)

- Bank statements (Latest 1-year bank statement for both current and savings accounts)

- Property documents (Sale Deed, Share Certificate, Latest Maintenance Bill, Sanction Letter if applicable)

- Advance processing cheque

- Investment proof (Fixed Deposits, Shares, Fixed Assets)

- Passport-size photographs

Important Notes:

💰 Income proof is crucial for home loan approval. If your salary is not credited to a bank account, most banks won’t approve your loan. However, some NBFCs may consider your application but at higher interest rates.

📢 Policy Updates: The Union Cabinet has recently introduced a 10% reservation for economically weaker upper castes, and the Finance Ministry may soon increase the tax exemption limit under Section 80C of the Income Tax Act, benefiting middle-class taxpayers.

Why Choose MyLoanKart?

Home loans are offered by various top banks and NBFCs, making the selection process time-consuming. MyLoanKart helps streamline your search by matching you with the best lender based on your requirements. Here’s why you should choose MyLoanKart:

- Online Marketplace – MyLoanKart is a trusted online marketplace for loans, providing unbiased suggestions.

- 19 Million Satisfied Customers – Over 19 million customers have successfully secured loans through MyLoanKart.

- Instant Quotes from Top Lenders – Get real-time quotes from leading banks and NBFCs.

- Expert Advice – Receive guidance from experienced loan professionals at MyLoanKart.

- Transparent Process – Experts are available to answer any queries related to your home loan application.

- End-to-End Service – MyLoanKart offers 100% assistance throughout the loan application process.